Everything about Feie Calculator

Table of ContentsUnknown Facts About Feie CalculatorGetting My Feie Calculator To WorkThe 25-Second Trick For Feie CalculatorThe Basic Principles Of Feie Calculator Some Known Details About Feie Calculator

He marketed his U.S. home to develop his intent to live abroad permanently and used for a Mexican residency visa with his other half to help accomplish the Bona Fide Residency Test. Furthermore, Neil secured a long-lasting residential property lease in Mexico, with plans to ultimately purchase a home. "I presently have a six-month lease on a house in Mexico that I can expand another 6 months, with the purpose to purchase a home down there." However, Neil mentions that acquiring building abroad can be challenging without very first experiencing the place."We'll absolutely be outdoors of that. Even if we return to the US for physician's consultations or business calls, I doubt we'll spend greater than thirty day in the United States in any kind of offered 12-month duration." Neil emphasizes the significance of stringent tracking of U.S. visits (American Expats). "It's something that people require to be truly thorough concerning," he states, and advises expats to be mindful of typical errors, such as overstaying in the U.S.

Feie Calculator for Dummies

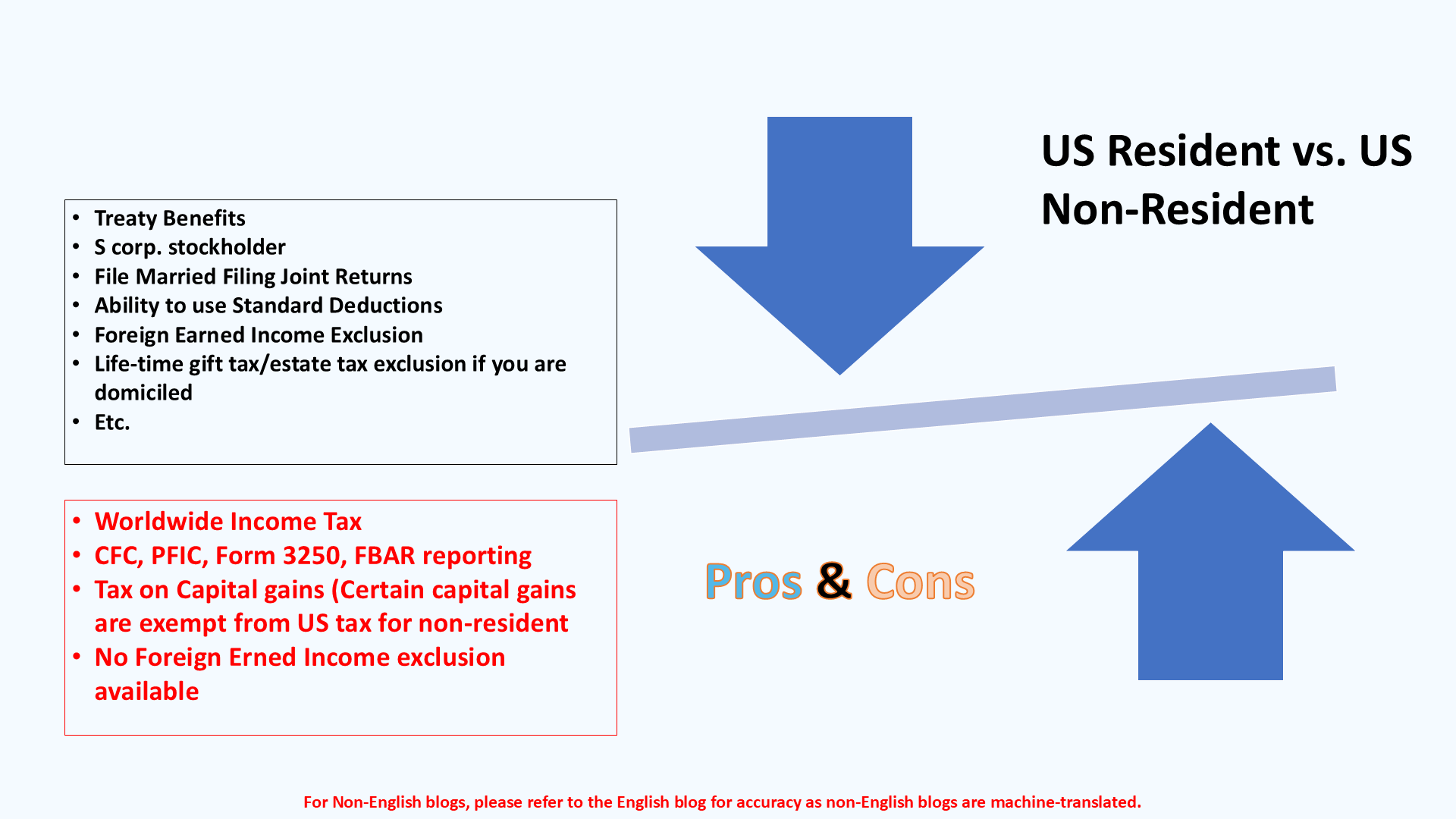

tax responsibilities. "The reason why U.S. taxation on worldwide income is such a large bargain is since lots of people neglect they're still based on U.S. tax even after moving." The U.S. is one of minority countries that taxes its residents despite where they live, meaning that even if an expat has no income from U.S.

tax obligation return. "The Foreign Tax Credit report permits individuals operating in high-tax nations like the UK to counter their united state tax obligation obligation by the amount they've currently paid in taxes abroad," states Lewis. This makes sure that deportees are not tired twice on the very same income. However, those in low- or no-tax countries, such as the UAE or Singapore, face added obstacles.

The Definitive Guide to Feie Calculator

Below are several of one of the most often asked questions concerning the FEIE and other exclusions The International Earned Earnings Exclusion (FEIE) permits united state taxpayers to omit approximately $130,000 of foreign-earned earnings from federal income tax obligation, minimizing their U.S. tax obligation obligation. To receive FEIE, you should satisfy either the Physical Visibility Test (330 days abroad) or the Bona Fide Home Examination (verify your key house in a foreign country for an entire tax year).

The Physical Visibility Test additionally needs U.S (Foreign Earned Income Exclusion). taxpayers to have both a foreign earnings and an international tax home.

Some Of Feie Calculator

An income tax treaty between the U.S. and an additional nation can help protect against double taxation. While the Foreign Earned Income Exclusion decreases gross income, a treaty may offer extra advantages for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a called for declaring for U.S. residents with over $10,000 in foreign financial accounts.

Qualification for FEIE depends on meeting specific residency or physical presence tests. He has over thirty years of experience and now specializes in CFO solutions, equity settlement, copyright taxes, marijuana taxes and separation associated tax/financial preparation matters. He is a deportee based in Mexico.

The international earned revenue exclusions, occasionally referred to as the Sec. 911 exemptions, omit tax obligation on earnings earned from working abroad. The exemptions make up 2 parts - an income exclusion and a real estate exemption. The following FAQs review the benefit of the exclusions including when both partners are expats in a general manner.

Feie Calculator - An Overview

The revenue exclusion is currently indexed for inflation. The optimal annual earnings exclusion is $130,000 for 2025. The tax obligation advantage omits the revenue from tax at lower tax obligation prices. Previously, the exemptions "came off the top" reducing revenue based on tax obligation on top tax prices. The exclusions may or might not decrease income utilized for various other purposes, such as IRA restrictions, child debts, personal exemptions, and so on.

These exemptions do not spare the wages from United States tax however just supply a tax obligation decrease. Note that Visit Website a solitary individual functioning abroad for every one of 2025 that gained about $145,000 without any various other earnings will certainly have taxed earnings minimized to zero - efficiently the same answer as being "free of tax." The exclusions are computed daily.